Consolidating Debt – Investing In Debt Management

John Dewey had quoted that a person’s money had more value than their credit. However, today’s creditors, like banks, do not share the same view. A good credit file report history is essential for obtaining personal loans thus, consolidating debt might be one of the next options. However, the inability to repay personal loans causes people to avoid calls from debt collectors and to miraculously pretend to forget any debts owed to their creditors.

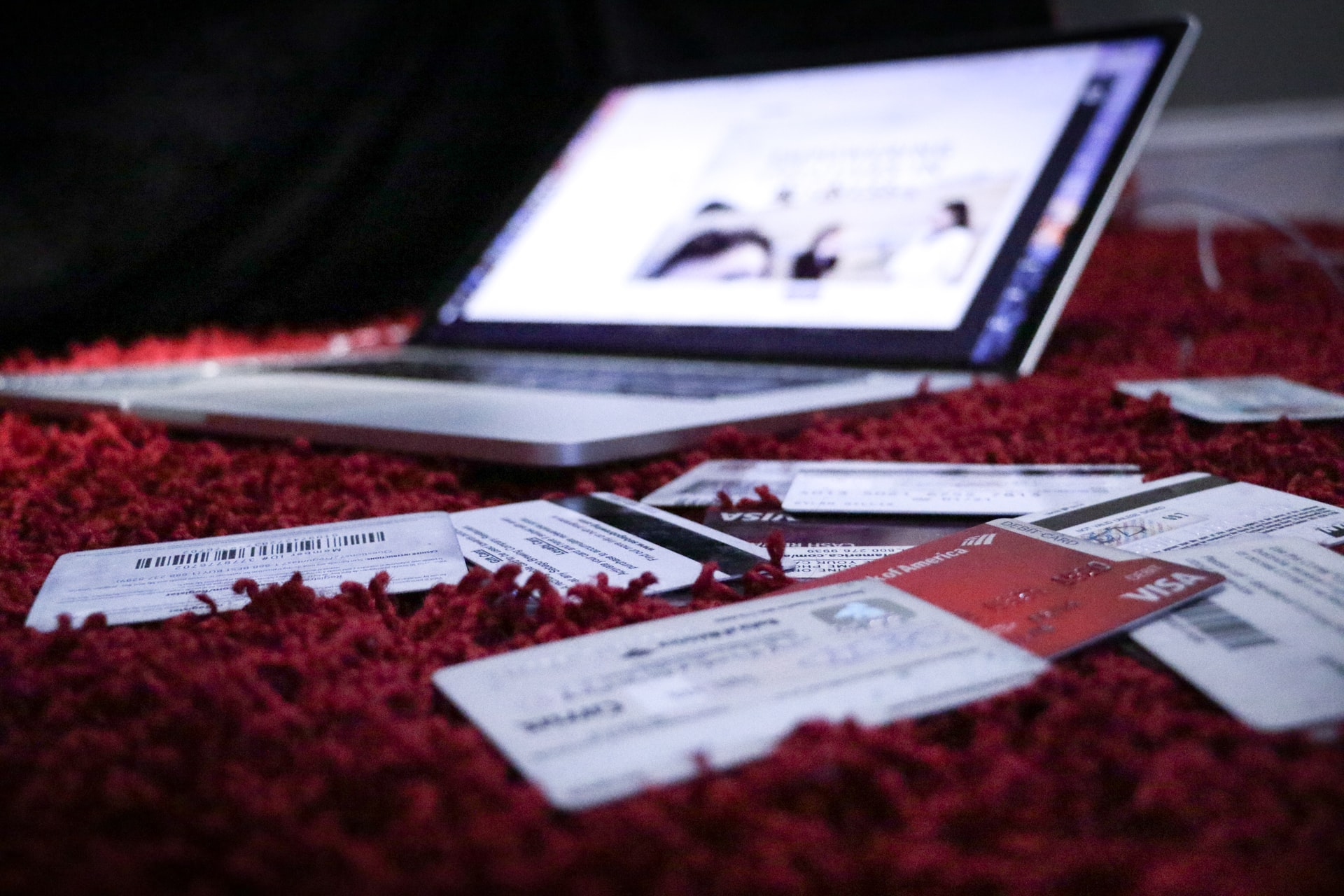

The resulting fact is that all your banking, financial, purchasing, credit and store card, and other credit history is reported to credit bureaus by your creditors and recorded on your credit file. This file is designed to assist creditors, like banks, to evaluate your credit history and any risk you may pose in regards to repayments.

Bad credit is not a dead-end street, and you can repair and rebuild it in time with the proper management of your finances. However, one or more bad credit reports on your file will have you blacklisted by the banks, destroy your credit score, and stop you from investing in something you want, like a car.

A creditor’s negative credit report takes up to 7 years before it is removed from your credit file. However, you still need at least one year of good credit reporting after that before you can start getting credit or personal loans again. To avoid waiting 7 years for the item you want, like a car, even though you may have a very good income and professional status, consider a problem-free, loan for those with bad credit. Simply, apply to consolidate debt, your debts.

A debt management loan for those with bad credit does have a higher rate than normal personal loans. However, such a loan focuses on your current situation and regular and steady employment, whilst ignoring your past credit report history.

You benefit from promptly fixing your credit report history and credit score, and you can start to rebuild your life. You have the opportunity to work towards buying a home or negotiating a lower interest rate on your credit cards.

If you make your payments when they are due, the bad credit history personal loan will work for you. Without this, you cannot benefit from any major purchases you wish to make, like buying a car. This loan will work if you make it work.

Again, bad credit report history is fixable and not the end of the line for you. Most people have experienced bad credit at least one or more times in their life. Now is the time to rebuild and create your positive credit future by considering the benefits to you by using a bad credit history, personal loan, and the workable interest rates they provide. Need to learn more important benefits of consolidating debt? We can help!